Cluff Gold Chairman, Mr Algy Cluff commends the SL Government on its successful Investment Conference staged in London

The Sierra Leone Government staged an Investment Conference in London titled “Working in Partnership” which was attended by over 100 investment professionals on Thursday 20th October. The Conference was hosted by the High Commissioner and attended by Ministers which included Dr Richard Konteh, Minister for Trade and Industry.

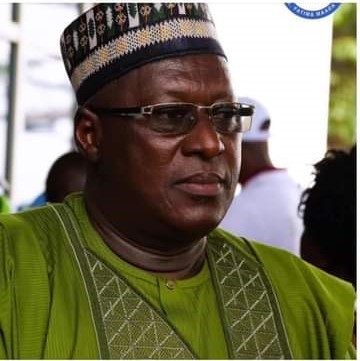

At the Conference, Mr Algy Cluff, (in photo) Non Executive Chairman of Cluff Gold plc, praised the Government for taking the initiative to organise the Conference which was used to highlight the investment opportunities open to international investors in the Country.

Below is a copy of the full speech that Mr Algy Cluff gave on the day.

I would firstly like to commend the Sierra Leone High Commission, The High Commissioner himself, the Deputy High Commissioner and Florence Bangalie, the Head of Chancery for the hard work which they and others have invested in the organisation of this Conference, in this unusual location. It is particularly encouraging also for those of us engaged in business in Sierra Leone but having to raise capital outside of the country to remark that no less than six cabinet ministers have taken the trouble to attend this conference thereby confirming the whole point of the conference- that is that Sierra Leone needs foreign investment and that Sierra Leone wants foreign investment and I would add that on the record of the government’s performance recently, Sierra Leone deserves foreign investment.

Now Sierra Leone is of course a Commonwealth country and I am happy to offer a warm welcome to the Coalition Government’s reversal of the previous Labour Government’s tendency to devalue the Commonwealth in favour of anything European. There was even a rumour that they were planning to drop the word Commonwealth from the Foreign and Commonwealth Office. At no time during the fifteen years of Labour’s Government did they, as far as I was concerned, exhibit at any point any enthusiasm for trade in Africa it was always aid. That neglect has contributed to the difficulties which British companies have experienced and in part has led to the dominant position now held by Chinese and Indian commercial concerns in Africa. However, this Commonwealth is a mighty organisation in concept and in reality and I believe it eases immeasurably the challenges of business and I strongly endorse the Coalition Governments recognition of this. I would also add that the reopening of the British Embassy in the Ivory Coast would seem to herald the reawakening of a new British independent Foreign policy in Africa which is most welcome to those of us who labour, (no pun intended) to advance Britain’s commercial cause.

Now I need to maintain a sense of proportion regarding Sierra Leone itself. It is not an investment Valhalla where nothing is faulty but then nor is anywhere else. What the country offers is the opportunity to participate in a commercial renaissance whether it be in the mining, oil, hotel, agricultural or many other sectors.

Indeed I would say that Sierra Leone is the most improved destination for investment in Africa in the past five years and remember that by reason of its membership of the Commonwealth, foreign investors are operating within the framework of British Law. The Government of Sierra Leone has adopted a welcoming attitude to foreign investors typical of many African countries I have to say. That approachability is absolutely fundamental to encouraging foreign investment which is why I have invested in many African countries, but not is Cuba, Vietnam or France! I do not speak for the Sierra Leone Government but I believe they understand – certainly in the minerals business – that the dynamics of investment can change dramatically and drastically almost overnight and that the foreign investor must know where he stands and be able to take a ten year view. We at Cluff Gold are now contemplating an investment of over $200 million and in order for us to raise such a sum the Government needs to be our partner rather than our adversary. I have seen many examples of the latter spanning a long career in natural resources. I was involved in the early days of the exploration for Oil in the North Sea. It was not long before the Labour Government (yes them again) could not resist becoming involved beyond the fiscal boundaries by establishing a State Oil Company, the so called British National Oil Corporation, one of the biggest examples of waste of executive time in British History. One of the more lunatic tendencies was to appoint a bureaucrat to attend the operating commercial committee meeting of the Oil Companies. That I remember saying at the time it was as if prisoners of war invited the camp commandant to attend their escaping committee meetings.

May I now turn to the specifics of our involvement in Sierra Leone. Gold was discovered in Baomahun near the district capital of Bo, 250 kilometres from Freetown, in the 1930’s by a German company but no commercial operations resulted. In the 1980’s Harry Winston the New York based, diamond magnate embarked on an exploration programme targeting diamonds. To his dismay they made not a diamond discovery but one of gold. He shortly thereafter died – not cause and effect – and a fifteen year battle began to establish probate to his estate. During this time one of his sons Ronald maintained the integrity of the license and indeed conducted a drilling programme which was terminated by the Civil War. In 2004, I negotiated an earn in arrangement on behalf of Cluff Gold with Mr Winston whom I have known for forty years and who is a true friend of Africa and of Sierra Leone in particular.

This earn in agreement provided for Cluff Gold to assume $5 million of exploration expenditure to obtain 60% of the license. Subsequently Cluff Gold acquired the remaining 40% of the license. We have conducted active exploration in difficult terrain and – as recorded in a recent press release – the Baomahun License currently contains 2,070.000 ounces in the measured and indicated category and a further 800,000 ounces inferred. This has been achieved at a discovery cost of $10 per ounce of gold which is I would claim an extremely efficient application of exploration expenditure. Within days we shall be in receipt of the final economics of the project contained in the Bankable Feasibility Study which will launch our drive to secure the capital to produce a new world class gold mine capable of producing 140,000 ounces of gold per annum for up to ten years on the basis of our present knowledge of the reserves, although, clearly additional exploration may augment this figure. I must stress that there remains outstanding issues of agreement to be finalised with the Sierra Leone Government before we can initiate our fund raising and I am confident that they will be rapidly resolved.

As a gesture of confidence in that judgement on our part we are to commence the development of Baomahun with a programme of road building and camp construction next month. I should on our behalf also take this opportunity to point out that we have already spend over $30 million on exploration and have and are supporting various charities in the country aimed at health and education. Most recently we have committed $325,000 to fund post graduate studies for seven students at the Tarkwa School of Mines in Ghana.

The investment landscape in Africa is changing and evolving constantly. When I look back to the opening of our first mine in Zimbabwe in 1981 it is remarkable how much more sophisticated that landscape has become. It is however interesting to reflect that that money was raised in London and thirty years later we still look primarily to London for our financial support. The mining industry was then almost exclusively an Anglo-Saxon business – now it is the Chinese and Indians who are challenging that dominance and the era of the African entrepreneur has dawned and very welcome it is too. We in Europe seem determined to place ourselves at a disadvantage with the Bribery Act being the latest shackle to undermine our competitive edge. There is something infuriating about this assumption that we are all intent on behaving badly unless legislation is in place to prevent us doing so. Some years ago (outside the statute of limitations) I approved the payment of various invoices to London Hospitals for an African Minister who was seriously ill with cancer. Was that an act of compassion or a bribe? No one knows such is the moral muddle the busy bodies have devised for us. I have been involved as a businessman in Africa for longer I am sure that anyone in this room and it may surprise you to know that the only attempt to bribe me was by an Englishman not an African.

The other issue which all foreign investors are now addressing is the concept of local empowerment. This is a complicated matter and it is crucial for Governments to get the balance between two apparently conflicting aspirations right. In my opinion the simplest methodology for this is through the Stock Markets. I respectfully commend African Governments to examine the benefits the stock market can provide and I believe listing for foreign mining companies (which are producing) on the local markets would have many advantages including local participation but also it would facilitate the movement of capital in and out of Africa and by definition the disciplines of corporate governance by which public companies have to abide. So the scene is set in Sierra Leone for a period of sustained growth which will result from a partnership between the international private sector and the Sierra Leone Government – maybe an African version of Hong Kong or Singapore. After all Sierra Leone people have the intelligence required and the raw materials which Hong Kong and Singapore don’t.

Thank you

Stay with Sierra Express Media, for your trusted place in news!

© 2011, https:. All rights reserved.