Residential mortgage financing and home finance law

Home owners have been financing construction of houses either by their own funds or through short term loans from friends, relatives and from the money market. This has made construction of most housing units a long and challenging venture. It could take over 10 years to complete a house; practically though, the entire country is littered with structures called dwelling places which do not qualify to be described as house or home.

The need to develop a modern, deliverable, sustainable and affordable housing finance scheme suitable and adaptable to the needs of the people of this country cannot be over emphasized.

The reality is as poignant as the clear blue sky.

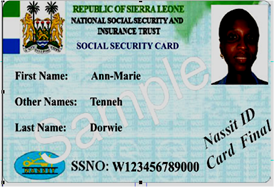

The National Social Security Insurance Trust (NASSIT) in pursuance of this need formed a private limited liability company, the HFC mortgage and saving (SL) Ltd to provide residential mortgage loans and mortgage linked consumer loans to prospective and qualified applicants.

This NASSIT sponsored pioneering mortgage finance institution aims at making it possible for individual and groups with ascertainable income to borrow or finance acquisition of houses and spread the repayment thereof over a period of time through longer term mortgage loans. The home mortgage loans! The home mortgage finance act is part of the broader objective to establish a sustainable and affordable housing system by introducing the enabling legal environment for mortgage financing.

The condition for a flourishing mortgage industry requires accessible long term funding and an enabling legal and regulatory environment. The bold economic step being taken by the Ministry of Finance including the setting up of a stock exchange reflecting modern financial and business practices are positive steps towards erecting the requisite environment for accessing long term funding. The role of NASSIT, other finance houses and high network individual homes and abroad in providing the appropriate funding mix of medium and long term funds is a clear and apparent gap in development ventures in the country.

This demands a much more transparent, friendly and efficient legal and regulatory environment that will generate confidence and encourage investors and prospective home owners to make long term commitment toward funding and take up a mortgage statutes governing mortgages in Sierra Leone.

The fear though is that this may hinge on the aged old and outdated English Law of General Application dating back to 1881. These laws are inadequate to protect the interest of both lenders and borrowers, hence the introduction of the home mortgage finance law. The financial system prior to the application for a mortgage finance license by HFCMS Company has no regulation for mortgage financing.

Indeed the then governor of The Bank and now the Minister of Finance took up the challenge in establishing the regulatory framework for mortgage industry, with the passage of the Companies Act, the coming into operation of the stock exchange and the establishment of the securities could not have done more for development of a thriving mortgage industry. The legal and land administration system are yet to be transformed from traditional land ownership system by developing legally protected and commercially tradable interest in land.

Extension of freehold interest in land as pertain in the western area to the provinces, may be one of the solution, caution must however be exercised by Land Administrator and Law Officers who should be mindful of the importance of land ownership to the mortgage home.

Stay with Sierra Express Media, for your trusted place in news!

© 2009, https:. All rights reserved.